Feature 14 — Block Rewards and Community Driven Monetary Policy — has now been approved by block generators and will shortly go live on mainnet. As we move towards creating a sustainable, self-regulating monetary system, we’d like to give an overview of the options for collecting revenues on the Waves platform.

Blockchain is built on the principle of decentralization, but no platform to date has taken this to its logical conclusion. While network infrastructure may be dispersed, network properties are typically centrally decided and hard-coded. On 7 October, Waves Platform will see the activation of a protocol that will allow the community to act as the decentralized analog of a central bank’s monetary policy committee.

Block rewards

Block generators’ revenues are set to increase significantly thanks to the introduction of a block generation reward, on top of the current transaction fees. This will bring block generators’ revenues up to a target figure of around 5% annually.

Feature 14, Block Reward and Community Driven Monetary Policy, has now been approved by block generators and will be activated on mainnet in the next few days. This feature essentially hands control of Waves’ monetary policy to block generators and the community, who can collectively decide whether to increase, decrease or leave block rewards as they are. The initial block reward will be 6 WAVES.

For those who wish to take advantage of this new development, there are two main options: running a full node and mining yourself, or leasing your WAVES to a mining node.

Mining

Mining is generally the best option for those willing to install and run a Waves node. For mining, you will need to maintain a node balance of at least 1,000 WAVES. Additionally, you will need to factor in hosting costs for your server, which you can rent from Amazon or any other cloud provider. You don’t need anything too fancy — 2 vCPUs, 4 GB RAM and 80 GB storage should be enough. As an example, Digital Ocean charges $20 per month for a Droplet with these specifications.

Block generators collect 40% of transaction fees for the generated block and 60% for the previous block. This 40/60 ratio is due to the specifics of the platform’s Waves-NG block generation protocol.

Block generators’ revenues

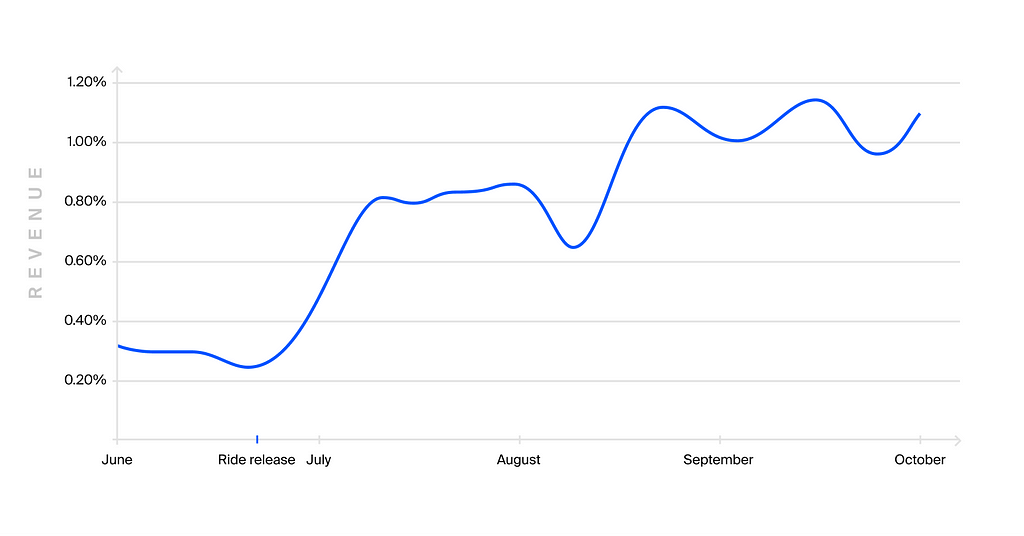

In recent weeks, Waves block generators have seen their revenues from transactions increase, thanks to the launch of the programming language Ride and the growing number of dApps on the Waves Platform (see above).

Revenues are now set to increase further. Assuming the initial block reward of 6 WAVES is maintained, rewards will increase to around 5% per year. (In practice, this may change since full nodes will vote every 100,000 blocks whether to keep this the same, raise it or lower it.)

Leasing

Those who do not want to install a node themselves and pay the running costs can still collect revenues by leasing their WAVES to other nodes. By doing so, WAVES holders can not only generate income but also help make the network more secure: the greater the proportion of total tokens leased out, the more expensive an attack on the network will be.

Different nodes will offer varying proportions of the WAVES they receive as rewards to lessors, as well as their own tokens and other benefits. We will explore this further in a future article.

Stay tuned for more developments!

Read Waves News channel

Follow Waves Twitter

Watch Waves Youtube

Subscribe to Waves Subreddit

Waves’ staking policy and block rewards was originally published in Waves Platform on Medium, where people are continuing the conversation by highlighting and responding to this story.