It turns out that increasing block rewards indefinitely does not lead to ever-increasing inflation.

With the launch of Waves’ community-driven monetary policy, Waves nodes are able to change the rewards distributed with every generated block. This is a great step forward in handing over control of the protocol to the community. But does giving away responsibility for something as important as monetary policy invite serious unintended consequences?

‘Wisdom of the crowd’ or ‘Tragedy of the commons’?

There are two schools of thought when it comes to handing decision-making over to the community. One is the ‘Wisdom of the crowd’: the sense that collective decisions are often better because they draw on a wide range of opinions and information, take into account many factors that an individual or small team would not know or care about, and reduce the ‘noise’ and cognitive bias of centralised decision-making.

The second view is the ‘Tragedy of the commons’. This view holds that asking large numbers of people to make key decisions on matters they may not fully understand is a bad idea, because the majority are likely to opt for a solution that suits them but not necessarily everyone else.

In this instance, there is a clear risk. Obviously WAVES holders like receiving higher rewards for mining and leasing their coins. Humans are psychologically programmed to prioritise short-term rewards over long-term ones. (For good reason. In an evolutionary context, finishing the shelter you’ll need to survive the winter comes a clear second to making sure you have enough food to survive the week.) So what’s to stop them from increasing block rewards at every opportunity, and turning Waves into a massively inflationary protocol — eroding its value and ruining it for everyone?

This article explores that scenario. The conclusion is that there is, in fact, no risk of this happening — for reasons we’ll examine below.

Built-in limits

When we crunch the numbers, it turns out that Waves can never be hyperinflationary. In fact, over time, inflation will drop — even in the ‘worst case’ scenario that block rewards are increased whenever possible.

The reason for this is that the community still do not have complete control of the protocol. It’s a little like someone saying, ‘You can drive as fast as you like on this road’. Actually, you can’t. You can put the pedal to the metal, but you’re still limited by the top speed of your car. In the same way, Waves hands over control of its monetary policy to its community. But the terms of that control are still restricted. Specifically, the Waves protocol only allows block generators to increase block rewards by 0.5 WAVES at a time, and only every 100,000 blocks.

Block rewards start at 6 WAVES. Together, these limitations mean that Waves can never be hyperinflationary.

Example

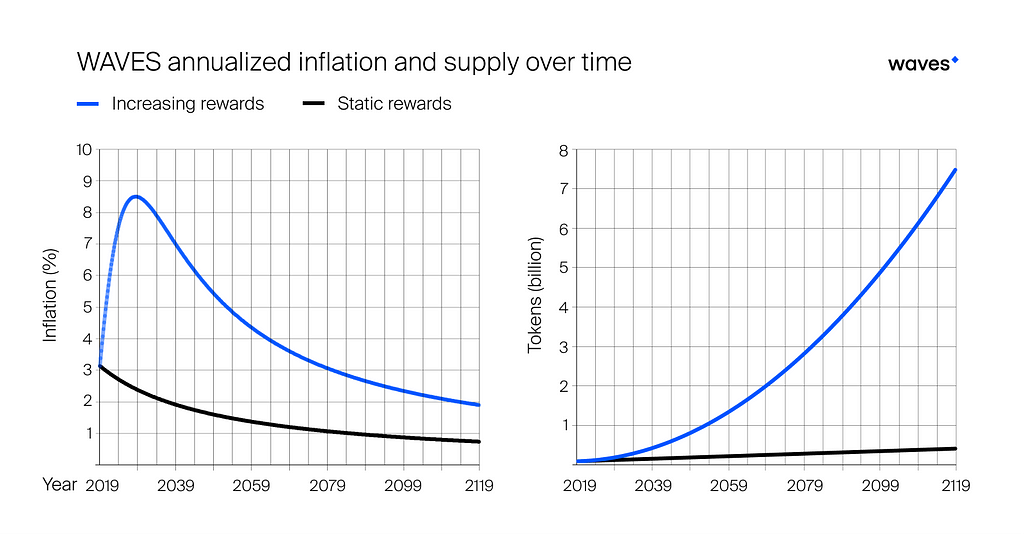

The chart below shows what happens in the maximum-supply scenario — an increase of 0.5 WAVES in block rewards every 100,000 blocks — as well as what happens when block rewards are maintained indefinitely at 6 WAVES as a ‘benchmark’. (Of course, it’s also possible that the community will opt to decrease block rewards, but we haven’t shown this scenario.)

Chart: Waves inflation with static and increasing block rewards

Waves begins with total supply of 100 million WAVES. Over the first 100,000 blocks (around 10 weeks), 600,000 new WAVES are created. Since there are 525,600 minutes in a year and Waves has a block time of around one minute, that represents an annualised increase (inflation) of 3.15%.

Then block rewards are raised to 6.5 WAVES for the next 100,000 blocks, or another 650,000 WAVES for this period. Since at the start of this period total supply is now 100,600,000 WAVES, this represents annualised inflation of 3.4%. And so it continues. However, even with increasing block rewards, the new WAVES represent a lower and lower proportion of the existing — and rising — supply.

Inflation peaks at 8.5% after around 5 million blocks (9.5 years), by which time total supply has doubled to 200 million WAVES. It then begins to fall again.Inflation will fall to just 2% after 50,600,000 blocks, though this will take almost a century. (And as Keynes said, in the long run we are all dead.)

Crypto and inflation

Even if supply is increased at the maximum possible rate, Waves’ inflation will never be more than 8.5%.

While 8% is a lot by conventional central bank policy standards — most central banks target 2% inflation, with varying degrees of success — it’s low compared to ‘inflation’ in the early years of PoW coins, including Bitcoin, and it’s low for a rapidly-expanding ecosystem. Inflation only results in the debasement of the currency if it does not result in increasing economic activity and expansion.

Of course, many members of the community will not be comfortable with any inflation at all. A large proportion of crypto-adopters are interested in digital money because they are dismayed with QE and fiat money printing. This is a valid opinion, and these members can vote to reduce block rewards with their WAVES. Those who run a node directly can vote to decrease rewards by 0.5 WAVES each 100,000 blocks. Those who prefer not to run a node themselves can lease their WAVES to a node that supports a decrease.

It is impossible to say at this point what the community will vote for — increasing, decreasing or static block rewards. But it’s interesting that even if holders vote for what central banks would call the loosest possible monetary policy, annual inflation is always capped.

Read Waves News channel

Follow Waves Twitter

Watch Waves Youtube

Subscribe to Waves Subreddit

Waves community-driven monetary policy was originally published in Waves Platform on Medium, where people are continuing the conversation by highlighting and responding to this story.